African Development Bank and Interpeace join hands to promote Peace Finance in Africa

Photo credits: AfDB

Abidjan, 3 October 2023 - The African Development Bank and Interpeace, an international organisation for peacebuilding based in Switzerland, today signed a memorandum of understanding to jointly promote economic investment and social development that positively impacts peace.

The memorandum is accompanied by a practical work plan with goals and outcome targets, underscoring the innovative partnership between the Bank and the Finance for Peace initiative by Interpeace.

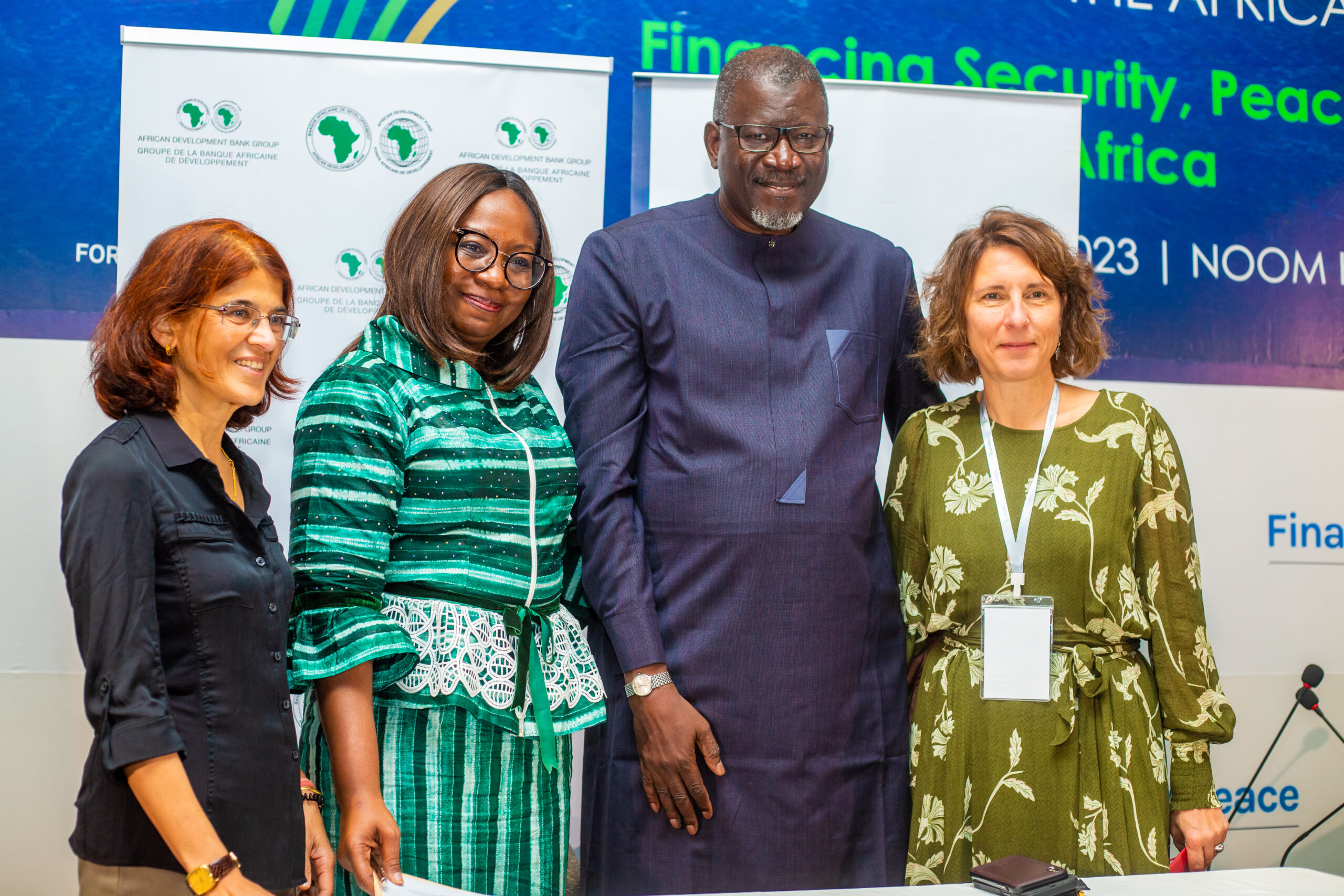

The signing ceremony took place during the Africa Resilience Forum currently underway in Abidjan, Côte d’Ivoire. The MoU was signed by the Bank’s Vice-President for Regional Development, Integration and Business Delivery Marie-Laure Akin-Olugbade, and a member of Interpeace’s governing board Elhadj As Sy.

Ambassador Deike Potzel, Director General for Crisis Prevention, Stabilisation, Peacebuilding and Humanitarian Assistance at the German Federal Foreign Office, which supports Interpeace’s Finance for Peace initiative, attended the signing.

Akin-Olugbade highlighted the importance of pursuing innovative approaches to support peace and security on the continent.

“The African Development Bank is pioneering these efforts through the Security-Indexed Investment Bond (SIIB) Initiative, endorsed at the AU Heads of State Summit in February 2022”, she told participants, adding that the proposed bonds aim to raise additional financing at scale, including through capital markets, to mitigate structural drivers of violence and conflict. The initiative also aims to offset the fiscal implications of elevated security sector spending.

“The Finance for Peace initiative by Interpeace, supported by Germany, complements the Bank’s own efforts in this space, as it aims to develop protocols and pilots around peace finance, including for a peace bond asset class”, Akin-Olugbade said.

Photo credits: AfDB

Elhadj As Sy said: “Interpeace is delighted to formalise the partnership with the African Development Bank. “This strong collaboration between the AfDB and Interpeace affirms our joint commitment to catalyse private and public capital to work for a more inclusive, equitable and peaceful world”, he said.

“This partnership will demonstrate to the wider multilateral and international development financing system the need, benefits, potential and practicality of Peace Finance approaches on the continent and beyond. It will grow Peace Finance as a thematic investing approach, by developing early and successful pipeline development of Peace Finance and by fostering on-the-ground networks and capacities in Peace Finance in Africa.”

The areas for collaboration outlined by the Memorandum of Understanding, in accordance with the parties’ mandates, include:

- Technical and capacity strengthening for embedding Peace Finance approaches that realise peace impact into AfDB’s sovereign and non-sovereign operations and policy dialogue.

- Advisory support and collaboration to develop a pipeline of Peace Finance structures that realise peace impacts.

- Multistakeholder engagement and field building for wider political and investor support for Peace Finance.

As part of the partnership, a joint research project on peace-positive investment opportunities in Mozambique was launched by the two organisations recently.

Photo credits: AfDB